What does vat mean?

Definitions for vat

vætvat

This dictionary definitions page includes all the possible meanings, example usage and translations of the word vat.

Princeton's WordNet

VAT, value-added tax, ad valorem taxnoun

a tax levied on the difference between a commodity's price before taxes and its cost of production

tub, vatnoun

a large open vessel for holding or storing liquids

Wiktionary

vatnoun

A large tub, such as is used for making wine or for tanning.

vatverb

To blend (wines or spirits) in a vat.

VATnoun

Value-added tax.

VATnoun

Vigilance awareness training.

Wikipedia

VAT

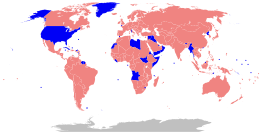

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues both worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD).: 14 As of 2018, 174 of the 193 countries with full UN membership employ a VAT, including all OECD members except the United States,: 14 where many states use a sales tax system instead. There are two main methods of calculating VAT: the credit-invoice or invoice-based method and the subtraction or accounts-based method. In the credit-invoice method, sales transactions are taxed, the customer is informed of the VAT on the transaction, and businesses may receive a credit for the VAT paid on input materials and services. The credit-invoice method is by far the more common and is used by all national VATs except for Japan. In the subtraction method, a business at the end of a reporting period calculates the value of all taxable sales, subtracts the sum of all taxable purchases, and applies the VAT rate to the difference. The subtraction method VAT is currently used only by Japan although it, often by using the name "flat tax," has been part of many recent tax reform proposals by US politicians. With both methods, there are exceptions in the calculation method for certain goods and transactions that are created to help collection or to counter tax fraud and evasion.

ChatGPT

vat

A vat is a large container or tank used for storing or holding liquids, typically used in the process of winemaking, brewing, or other productions in industries. It can also refer to a vessel where certain industrial processes like dyeing and chemical reactions take place.

Webster Dictionary

Vatnoun

a large vessel, cistern, or tub, especially one used for holding in an immature state, chemical preparations for dyeing, or for tanning, or for tanning leather, or the like

Vatnoun

a measure for liquids, and also a dry measure; especially, a liquid measure in Belgium and Holland, corresponding to the hectoliter of the metric system, which contains 22.01 imperial gallons, or 26.4 standard gallons in the United States

Vatnoun

a wooden tub for washing ores and mineral substances in

Vatnoun

a square, hollow place on the back of a calcining furnace, where tin ore is laid to dry

Vatnoun

a vessel for holding holy water

Vatverb

to put or transfer into a vat

Etymology: [A dialectic form for fat, OE. fat, AS. ft; akin to D. vat, OS. fat, G. fass, OHG. faz, Icel. & Sw. fat, Dan. fad, Lith. pdas a pot, and probably to G. fassen to seize, to contain, OHG. fazzn, D. vatten. Cf. Fat a vat.]

Wikidata

Vát

Vát is a village in Vas county, Hungary.

Chambers 20th Century Dictionary

Vat

vat, n. a large vessel or tank, esp. one for holding liquors.—v.t. to put in a vat.—n. Vat′ful, the contents of a vat. [Older form fat—A.S. fæt; Dut. vat, Ice. fat, Ger. fass.]

The Standard Electrical Dictionary

Vat

A vessel for chemical or other solutions. A depositing vat is one in which a plating solution is worked, for the deposition of electroplate upon articles immersed in the liquid, and electrolyzed by an electric current.

Editors Contribution

vat

A type of vessel created and designed in various colors, materials, mechanisms, shapes, sizes and styles.

Vats are used in restaurants, wineries and various other places.

Submitted by MaryC on December 16, 2016

Suggested Resources

VAT

What does VAT stand for? -- Explore the various meanings for the VAT acronym on the Abbreviations.com website.

British National Corpus

Spoken Corpus Frequency

Rank popularity for the word 'vat' in Spoken Corpus Frequency: #3937

Nouns Frequency

Rank popularity for the word 'vat' in Nouns Frequency: #1585

Usage in printed sourcesFrom:

- [["1515","1"],["1582","1"],["1629","1"],["1631","2"],["1638","2"],["1642","1"],["1644","1"],["1647","1"],["1656","3"],["1657","1"],["1658","2"],["1659","1"],["1666","1"],["1667","2"],["1669","2"],["1670","1"],["1672","2"],["1675","1"],["1676","1"],["1677","1"],["1678","7"],["1679","2"],["1680","2"],["1682","4"],["1683","5"],["1684","2"],["1687","1"],["1688","2"],["1690","3"],["1691","1"],["1693","2"],["1694","1"],["1695","3"],["1697","1"],["1698","5"],["1699","6"],["1700","6"],["1701","7"],["1702","5"],["1703","4"],["1704","5"],["1705","10"],["1706","6"],["1707","9"],["1708","3"],["1709","2"],["1710","9"],["1711","7"],["1712","3"],["1713","3"],["1714","23"],["1715","6"],["1716","6"],["1717","9"],["1718","5"],["1719","3"],["1720","4"],["1721","7"],["1722","8"],["1723","7"],["1724","2"],["1725","6"],["1726","10"],["1727","24"],["1728","9"],["1729","4"],["1730","4"],["1731","7"],["1732","6"],["1733","1"],["1734","5"],["1735","5"],["1736","1"],["1737","3"],["1738","4"],["1739","3"],["1740","6"],["1741","1"],["1742","8"],["1743","7"],["1744","24"],["1745","14"],["1746","6"],["1747","13"],["1748","7"],["1749","6"],["1750","15"],["1751","11"],["1752","6"],["1753","10"],["1754","10"],["1755","8"],["1756","2"],["1757","11"],["1758","9"],["1759","12"],["1760","16"],["1761","11"],["1762","3"],["1763","9"],["1764","12"],["1765","11"],["1766","49"],["1767","44"],["1768","17"],["1769","8"],["1770","24"],["1771","9"],["1772","51"],["1773","12"],["1774","66"],["1775","29"],["1776","27"],["1777","25"],["1778","44"],["1779","57"],["1780","2"],["1781","11"],["1782","16"],["1783","11"],["1784","22"],["1785","17"],["1786","17"],["1787","46"],["1788","31"],["1789","27"],["1790","34"],["1791","333"],["1792","30"],["1793","30"],["1794","38"],["1795","88"],["1796","157"],["1797","42"],["1798","25"],["1799","88"],["1800","113"],["1801","190"],["1802","148"],["1803","167"],["1804","254"],["1805","129"],["1806","106"],["1807","398"],["1808","151"],["1809","237"],["1810","258"],["1811","196"],["1812","225"],["1813","232"],["1814","227"],["1815","273"],["1816","76"],["1817","339"],["1818","266"],["1819","167"],["1820","578"],["1821","207"],["1822","320"],["1823","307"],["1824","843"],["1825","380"],["1826","256"],["1827","196"],["1828","272"],["1829","260"],["1830","1185"],["1831","344"],["1832","316"],["1833","293"],["1834","187"],["1835","475"],["1836","704"],["1837","263"],["1838","428"],["1839","487"],["1840","308"],["1841","426"],["1842","229"],["1843","452"],["1844","626"],["1845","349"],["1846","729"],["1847","357"],["1848","501"],["1849","530"],["1850","387"],["1851","638"],["1852","1371"],["1853","1199"],["1854","537"],["1855","445"],["1856","710"],["1857","656"],["1858","515"],["1859","551"],["1860","1183"],["1861","981"],["1862","370"],["1863","993"],["1864","463"],["1865","1006"],["1866","560"],["1867","604"],["1868","967"],["1869","794"],["1870","504"],["1871","874"],["1872","1150"],["1873","571"],["1874","574"],["1875","816"],["1876","1001"],["1877","956"],["1878","789"],["1879","606"],["1880","1003"],["1881","1354"],["1882","1030"],["1883","824"],["1884","852"],["1885","978"],["1886","643"],["1887","895"],["1888","1207"],["1889","1055"],["1890","1029"],["1891","1201"],["1892","819"],["1893","765"],["1894","1644"],["1895","1293"],["1896","1679"],["1897","2023"],["1898","2162"],["1899","1996"],["1900","2490"],["1901","3094"],["1902","2007"],["1903","2023"],["1904","3380"],["1905","2274"],["1906","2684"],["1907","2932"],["1908","2247"],["1909","2448"],["1910","2793"],["1911","2355"],["1912","4815"],["1913","2328"],["1914","2407"],["1915","1911"],["1916","1651"],["1917","1798"],["1918","2265"],["1919","2147"],["1920","3462"],["1921","3763"],["1922","1900"],["1923","2215"],["1924","1840"],["1925","1534"],["1926","1421"],["1927","2475"],["1928","1321"],["1929","1393"],["1930","1751"],["1931","1455"],["1932","1173"],["1933","1240"],["1934","999"],["1935","1106"],["1936","1316"],["1937","1865"],["1938","1284"],["1939","1632"],["1940","1454"],["1941","2709"],["1942","2323"],["1943","1097"],["1944","1446"],["1945","1598"],["1946","1933"],["1947","2956"],["1948","2118"],["1949","3293"],["1950","2403"],["1951","2030"],["1952","3312"],["1953","2573"],["1954","2673"],["1955","1999"],["1956","1571"],["1957","2429"],["1958","2388"],["1959","2068"],["1960","1888"],["1961","2249"],["1962","1974"],["1963","2702"],["1964","2369"],["1965","2936"],["1966","3297"],["1967","2790"],["1968","2935"],["1969","3768"],["1970","3416"],["1971","3831"],["1972","3644"],["1973","3855"],["1974","3927"],["1975","2837"],["1976","3151"],["1977","3521"],["1978","3343"],["1979","4002"],["1980","3318"],["1981","3742"],["1982","3192"],["1983","4539"],["1984","3303"],["1985","3973"],["1986","4567"],["1987","4674"],["1988","8862"],["1989","4683"],["1990","6112"],["1991","5277"],["1992","5557"],["1993","5732"],["1994","4862"],["1995","5981"],["1996","5909"],["1997","7007"],["1998","7085"],["1999","8843"],["2000","8732"],["2001","7962"],["2002","9714"],["2003","12309"],["2004","12001"],["2005","11267"],["2006","11725"],["2007","12740"],["2008","20078"]]

Anagrams for vat »

tav

ATV

ATV

tav

TVA

vta

TVA

vta

Numerology

Chaldean Numerology

The numerical value of vat in Chaldean Numerology is: 2

Pythagorean Numerology

The numerical value of vat in Pythagorean Numerology is: 7

Examples of vat in a Sentence

Colleagues in Brussels have been battling with fiscal issues, VAT issues, labor market reforms and I think it is fair to say that the judgment of everybody, including the Greek colleagues, is that we will not be there yet on Monday.

The VAT cut will not change the current imbalance between supply and demand.

The VAT cut is apparently good news for China's coal industry. The expected 4 percentage point cut will relieve a lot of pressure from domestic coal firms as they do not have many advantages competing with foreign mines in either price or quality.

Soybean arrivals were not that big in March. Many have moved shipments to April due to VAT rate adjustment... Most of the cargoes were Brazilian beans. Some U.S. shipments were delayed as well.

If the government wants a chance to catch up, it needs a proper strategy and enough cash to clean up our homes on a massive scale. This means substantial grants for heat pump installations, especially for the poorest families, removing VAT on green home technologies and a phase out of gas boilers early next decade.

Popularity rank by frequency of use

References

Translations for vat

From our Multilingual Translation Dictionary

- � ريبة القيمة الم� افةArabic

- Wanne, Trog, BottichGerman

- varboEsperanto

- cuba, tinaSpanish

- خم, خمره, خمبهPersian

- vati, sammioFinnish

- cuveFrench

- dabhachIrish

- coire, amarScottish Gaelic

- kerIcelandic

- tinozza, tino, tinozza da conciaItalian

- кацаMacedonian

- tonel, tinaPortuguese

- ка́дка, чан, бакRussian

- kaca, bačva, maštel, čabarSerbo-Croatian

- momsSwedish

Get even more translations for vat »

Translation

Find a translation for the vat definition in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Word of the Day

Would you like us to send you a FREE new word definition delivered to your inbox daily?

Citation

Use the citation below to add this definition to your bibliography:

Style:MLAChicagoAPA

"vat." Definitions.net. STANDS4 LLC, 2025. Web. 23 Feb. 2025. <https://www.definitions.net/definition/vat>.

Discuss these vat definitions with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In